Chargeable Consideration Fixtures and Chattels

In order to determine the correct amount of SDLT, we need to ascertain whether things are chattels, which are not part of the land or whether they are fixtures, which are part of the land.

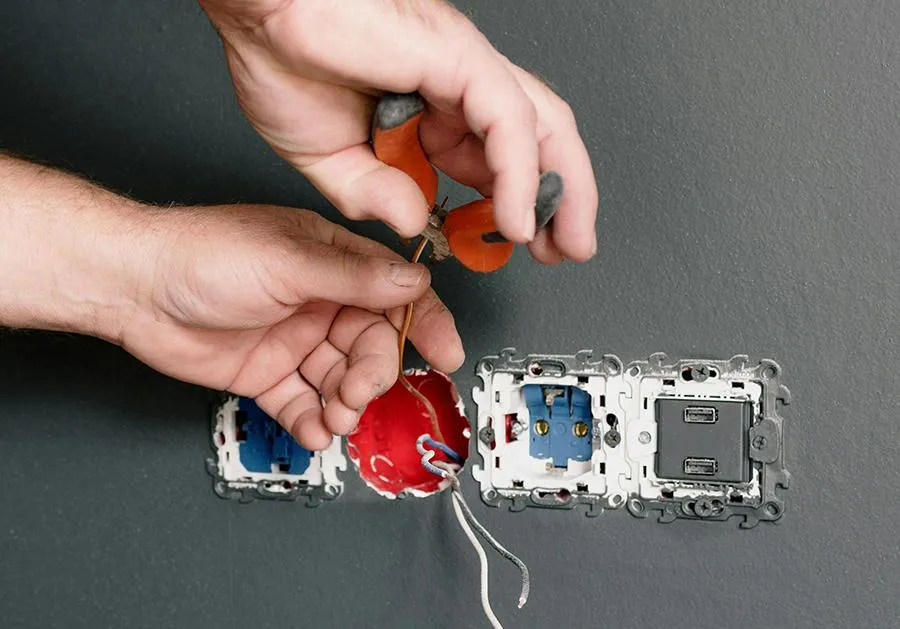

Permanent fixtures will be liable to SDLT and will include things such as:

fitted kitchen units, cupboards and sinks;

agas and wall-mounted ovens;

fitted bathroom sanitary ware;

central heating systems;

intruder alarm systems.

However, chattels are not liable to SDLT.

A chattel is something you can touch and move and includes:

items of stand-alone household furniture

carpets (fitted or otherwise), curtains and blinds;

kitchen white goods (unless fully integrated)

electric and gas fires (provided that they can be removed by disconnection without causing damage to the property);

light shades. items not permanently fixed to a building

If you think that SDLT paid included the cost of chattels, it should be possible to submit a reclaim for overpaid SDLT provided it is done within 4 years of completion. If the overpayment arose within 12 months of completion, it will be possible to amend the land transaction return (SDLT1).

HMRC will, however, expect the purchaser to discharge the burden of proof by showing that:

the figure includes chattels;

the items classified as chattels are not fixtures; and

the portion of the figure attributed to the chattels is reasonable.